Hello to the community!

Today we are excited to expand on previous announcements and share more details on the governance token for the Secret DeFi ecosystem – now known as $SEFI. (It’s short for Secret Finance, and yes, it rhymes with DeFi.)

This post will outline details on the proposed distribution for SEFI, including genesis and initial rewards structure. To summarize what follows, the following actions will be the most highly connected with SEFI genesis distribution:

- Staking $SCRT, the native coin of Secret Network (similar to the role of ETH on Ethereum) – note that you must stake your SCRT to be eligible.

- Interacting with Secret Bridges (turning assets from other ecosystems into secret tokens), including through providing liquidity to WSCRT pairs on ETH.

- Usage of SecretSwap (providing liquidity for pairs).

Initially SEFI will focus on governance of SecretSwap, the first cross-chain, front-running resistant decentralized exchange, which launched on mainnet in February. SecretSwap makes use of the SNIP-20 standard and Secret Ethereum bridge, and it will make use of bridges to other ecosystems (including the Secret Binance Smart Chain bridge). As the Secret DeFi ecosystem expands, it is possible for participants in SEFI governance to introduce additional mechanics based on the usage of other Secret DeFi products.

Read on to learn more about the SEFI token, Secret DeFi, and what’s next!

SEFI Genesis and Ongoing Rewards

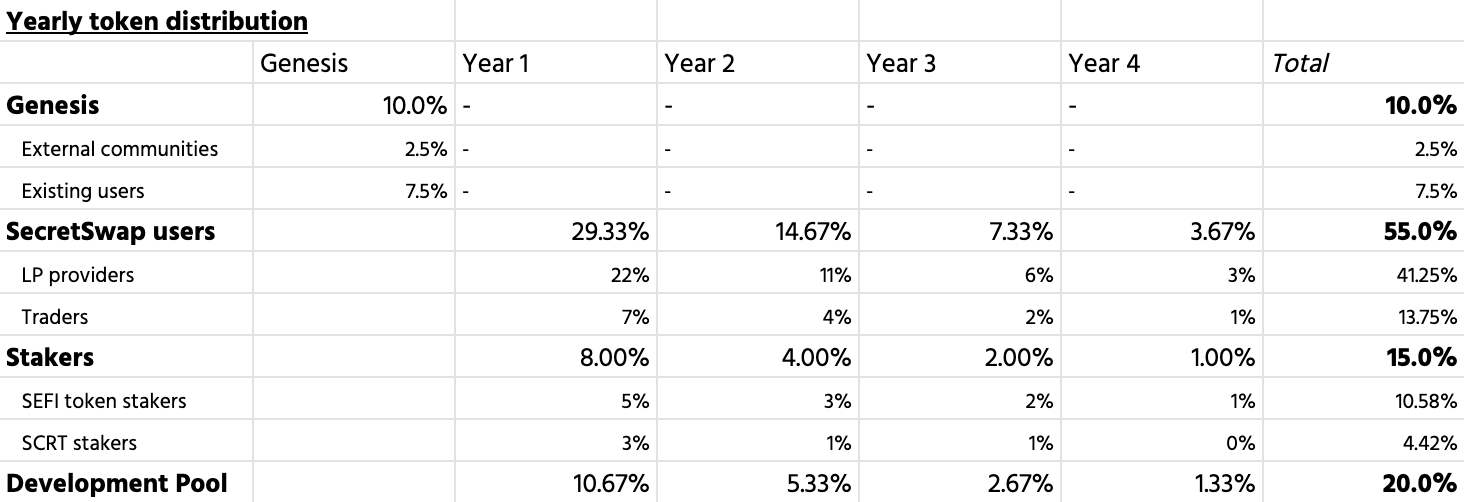

In this initial proposal, the SEFI token will be distributed in a one-time genesis event as well as to SecretSwap users over four years. The token emission and the details of each class of rewards can be seen below. SEFI is non-inflationary with a fixed supply.

10% of SEFI will be distributed at genesis. The remaining 90% of tokens would be distributed over four years, with rewards halving year over year. These parameters (e.g. weighting of rewards between LP Providers and Traders) could change in the future through governance.

Genesis Distribution

The genesis distribution of SEFI is designed to ensure a fair and broad distribution of tokens to existing SecretSwap users, as well as other prominent communities across Secret Network and Ethereum.

As part of a fair genesis launch, portions of this distribution will be based on historical activity and current snapshots that are curated by members of the Secret community. To prevent this from being gamed, these snapshots will be held at unannounced times between the publication of this blog post and SEFI genesis (expected to be near the end of this month, March 2021). These proposed allocations are subject to change based on further analysis and feedback.

At genesis, 10% of all SEFI supply is proposed to be distributed as follows:

Certain Ethereum DeFi communities that are supported on the Secret Ethereum Bridge (25% of genesis): All communities with $10M+ TVL deposited on the bridge at the time of snapshot will be eligible for WSEFI distribution on Ethereum. Certain communities may be included irrespective of their TVL.

Existing stakeholders on Secret Network (75% of genesis in total):

- SCRT stakers (35% of genesis): 35% of genesis SEFI tokens will be distributed to SCRT stakers who secure Secret Network, weighted by total amount staked. Staking SCRT helps to secure the underlying protocol, which in turn secures all Secret-based financial applications.

- SecretSwap LPs pre-SEFI genesis (25% of genesis): 25% of genesis SEFI tokens will be allocated to LPs of SecretSwap, who have been serving the Secret Network community by providing liquidity at the expense of impermanent loss. The TVL calculation will be done over time since the inception of SecretSwap. This means the liquidity you provide today will increase your chances in genesis distribution for eligible pools. Please read on to determine which pools are eligible for rewards.

- Secret Network – Ethereum bridge users (15% of genesis): 15% of genesis SEFI will be allocated for bridge participants who have bridged over $1000 (per asset) at the time of the snapshot. These rewards will be distributed based on a quadratic function to encourage wide distribution of SEFI among current bridge users. Bridge participation is extremely important for improving privacy guarantees of Secret Network. Note also that those who provide liquidity to WSCRT and bridge their LP tokens to Secret Network will also be eligible.

SecretSwap User Rewards

After genesis, SEFI will be distributed as rewards for providing liquidity and transaction volume on SecretSwap, as well as for providing liquidity to WSCRT and SEFI pools on other DEXes of note on other chains (e.g., Uniswap, Sushi). 55% of all SEFI supply is initially reserved for SecretSwap users.

- Liquidity providers (41.25%): Liquidity providers are allocated 75% of user rewards. LP tokens for eligible pools can be staked in order to receive SEFI tokens. These include LP tokens from other chains (e.g., Uniswap, Sushi).

- Traders (13.75%): Traders receive 25% of user rewards through a cash-back mechanism. Cash-back tokens are minted with each trade (weighted by trade volume). In other words, traders accumulate cash-back tokens every time they trade. These cash-back tokens can be burned to redeem SEFI tokens.

Eligible pools and rewards are as follows:

- High priority pools (HPPs): SecretSwap HPPs are SCRT/ETH, SCRT/WBTC, SCRT/USDT, SCRT/SEFI, and WBTC/ETH. HPPs have a weight of 4x.

- Pools over $50mn in liquidity will have a weight of 4x.

- Pools over $5mn in liquidity will have a weight of 2x.

- Pools over $1mn in liquidity will have a weight of 1x.

- Initially, WSCRT-ETH and WSEFI-ETH LP tokens will have a weight of 1x. This may expand to other networks/DEXes in the future.

Example: two pools have the same total value locked (TVL). Pool A has a weight of 4x, and Pool B has a weight of 1x. Pool A would receive 80% of the LP rewards per block, while the Pool B would receive 20% of LP rewards.

Note: During the pre-genesis period:

- The same high priority pools are still in effect with 4x weight.

- SCRT / asset pair for pools with over $5mn in liquidity will have 4x weight for LP reward distribution.

- SCRT / asset pair for pools with over $1mn in liquidity will have 2x weight for LP reward distribution.

- SCRT / asset pair for pools with over $250,000 in liquidity will have 1x weight for LP reward distribution.

SCRT and SEFI Stakers

A portion of SEFI supply is also reserved for users who support Secret DeFi and Secret Network through staking. SEFI token holders are required to stake SEFI in order to participate in the decentralized governance of SecretSwap (and other Secret DeFi applications, as governance allows). SCRT stakers increase the security of Secret Network, which underlies and secures SecretSwap and other Secret DeFi applications, so their participation is also critical. 15% of all SEFI supply is reserved for stakers.

- SEFI stakers (10%): ⅔ of SEFI allocated for stakers are distributed among SEFI stakers

- SCRT stakers (5%): ⅓ of SEFI allocated for stakers are distributed among SCRT stakers

Development Pool

Finally, 20% of SEFI supply will be allocated for a development pool for SecretSwap over 4 years. SEFI stakers will determine how the pool is spent through decentralized voting. Future Secret DeFi projects will be able to make proposals for SEFI that will help bootstrap initial liquidity and their user base.

Initial Function of SEFI

The SEFI token allows the Secret DeFi community to govern its protocol in a decentralized fashion. Some of the aspects that the community can govern include:

- Spending the development pool

- Determining pools eligible for user rewards, including changing their respective weights

- Joining other communities, for example, by enabling joint liquidity mining campaigns like Sushiswap Onsen

- SecretSwap fees and use of fees

- Adding other products into Secret Finance that receive and utilize SEFI

Only staked SEFI tokens will be eligible to participate in decentralized governance.

Next Steps

As we approach the genesis distribution for SEFI, we are now fully focused on increasing liquidity within the Secret DeFi universe. That means adding new asset support, building new bridges (such as Binance Smart Chain), and helping onboard new users so they can create “secret” versions of their own assets and provide liquidity to SecretSwap as well as other applications.

Recall again which actions are critical for the genesis distribution:

- Staking $SCRT, the native coin of Secret Network (similar to the role of ETH on Ethereum) – note that you must stake your SCRT to be eligible

- Interacting with Secret Bridges (turning assets from other ecosystems into secret tokens)

- Usage of SecretSwap (providing liquidity for pairs)

Currently over $75M in Ethereum assets have been bridged to the Secret ecosystem, but we’d like to see this number expand substantially over the coming weeks! SecretSwap itself is expected to see ongoing continuous improvements, both for its feature set and for its stability and usability. Over the coming weeks, we’ll share details on these future improvements here on the Secret Blog.

If you’re excited about the launch of SEFI and would like to start staking SCRT, providing liquidity on SecretSwap, or using our bridges and applications, come get support from the Secret community in the Secret Chat (Discord).

There are also many community guides and video walkthroughs available to help you get started on your Secret journey, a few of which are linked below!

How to use the bridge:

How to use SecretSwap:

Altcoin BuzzRuma –

Altcoin BuzzRuma –

How to stake SCRT:

Secret NetworkSecret Network

Secret NetworkSecret Network

Now let’s build a decentralized financial system that works better for real users – with front-running protections, data privacy by default, cross-chain assets, and the strength of our global community of Secret Agents behind it!

Onwards and upwards!

To discuss Secret Network and Secret Apps, visit our community channels:

Website | Forum | Twitter | Discord | Telegram

Try the Secret Bridge: bridge.scrt.network

Try SecretSwap: secretswap.net