Greetings Secret community,

Leveraging the power of Secret Contracts on Secret Network, Shade Protocol is launching ShadeBonds — the first bonds product in the entire Cosmos ecosystem! ShadeBonds are a treasury management tool that empowers users to privately interact with the ShadeDAO to earn yield.

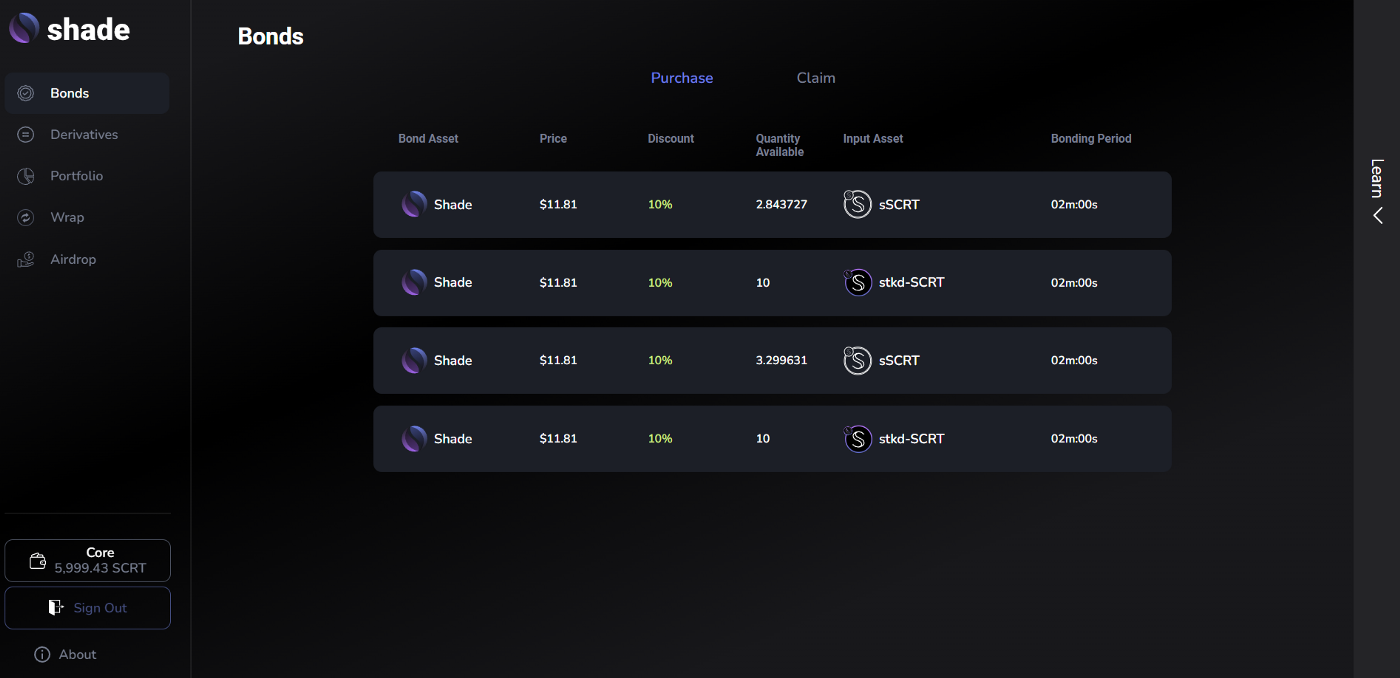

Simply deposit SNIP tokens (such as stkd-SCRT) into the ShadeDAO using ShadeBonds and earn yield!

For a full tutorial on using Shade Bonds, see https://shadeprotocol.substack.com/p/shade-bonds-tutorial. If you’d like to learn more about ShadeBonds before diving in, continue reading!

For users, the launch of ShadeBonds unlocks the following:

- Massive UI/UX overhaul of https://app.shadeprotocol.io/

- Deposit stkd-SCRT, stkd-SCRT/SHD — earn yield in the form of $SHD

- Bonds

- Derivatives

- Portfolio

- Learn Tab

- Wrap functionality (SCRT ← → sSCRT)

- Shade airdrop in late September for qualified users

Months of work have resulted in this vastly improved and simplified user experience — in the future even more privacy-preserving DeFi primitives will be added, empowering users with a seamless and unified DeFi experience on Secret Network.

Learn more about ShadeBonds:

https://docs.shadeprotocol.io/shade-protocol/

Profit Scenario

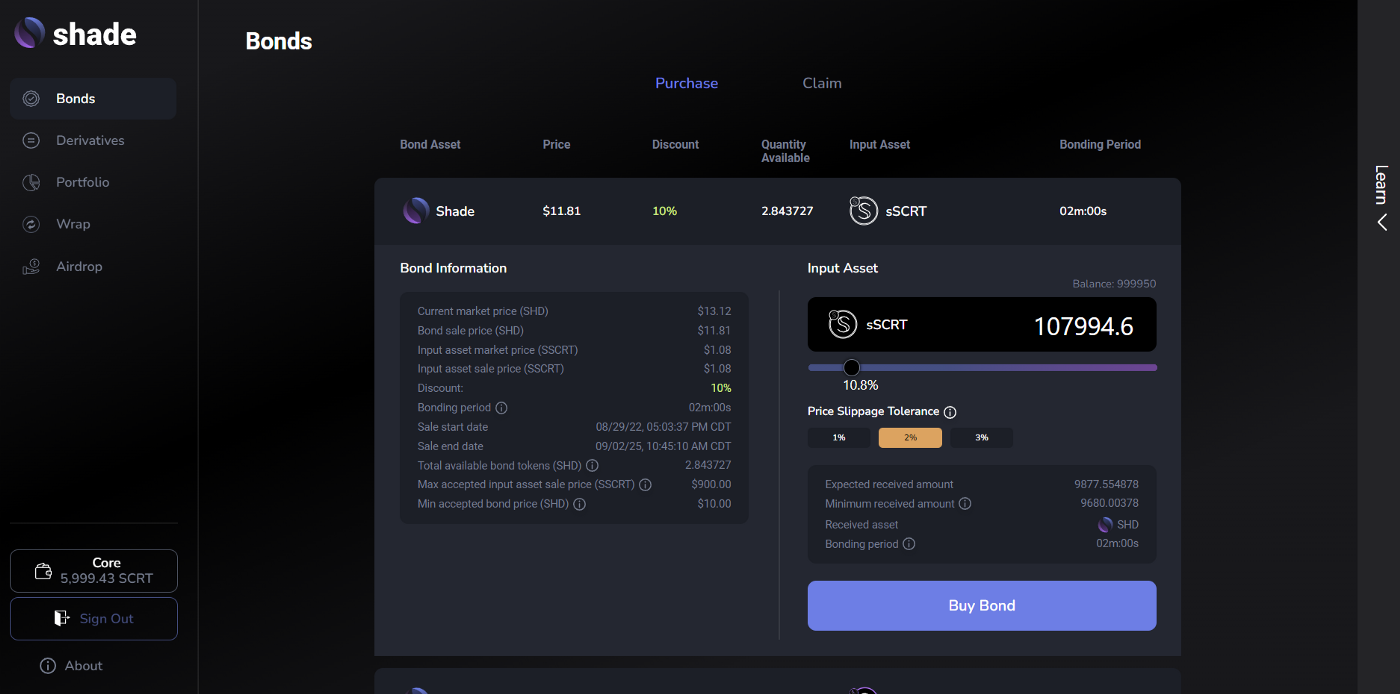

Assume that SHD is trading at $10

(1) User deposits $900 worth of ATOM into the bond contract

- A 10% bond discount locks in 100 SHD for claim (worth $1,000)

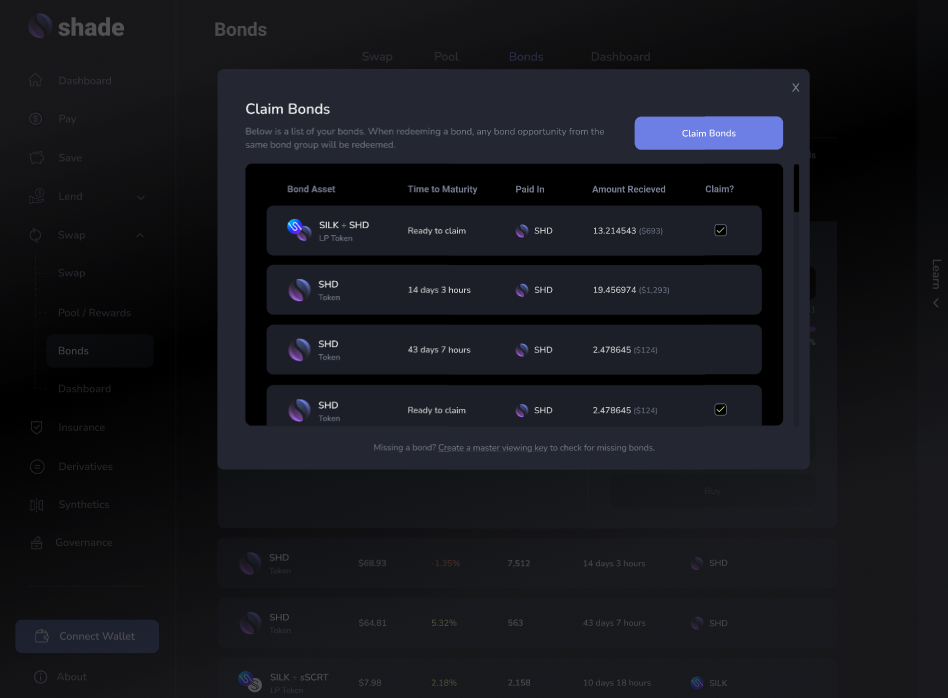

(2) User waits 14 a day vesting period

(3) User claims 100 SHD worth $1,000.

Loss Scenario

Assume that SHD is trading at $10

(1) User deposits $900 worth of ATOM into the bond contract

- A 10% bond discount locks in 100 SHD for claim (worth $1,000)

(2) User waits 14 day vesting period

(3) Price of SHD decreased to $8

(3) User claims 100 SHD worth $800

From here, a user can sell their claimed SHD for a $100 loss.

Bond Types

The issuance policy of Shade Bonds is split into three different categories:

- Bounded

- Unbounded

- Treasury

A bounded bond sells SHD to the open market using SHD that was preminted into the ShadeDAO at the inception of the protocol. An unbounded bond uses SILK or SHD that is minted after the inception of the protocol. A treasury bond sells digital assets from the ShadeDAO (such as SCRT or ATOM) that were acquired from protocol revenue, bonded bonds, or unbounded bonds sales.

Collateral Types

There are four different types of collateral deposited by users into the bond contracts:

- Yield Bearing

- Stablecoins

- Store of Value

- Liquidity Tokens

Yield bearing asset are any sort of collateral that is capable of generating yield without experiencing the risk of impermanence loss. Examples of yield generating assets are tokens such as ATOM and SCRT which are all capable of being staked to generate yield.

Stablecoins are digital assets that hold a target price and are able to be redeemed or sold at the target peg regardless of market conditions. The quality of a stablecoin is based on six variables:

- Liquidity

- Bridge risk

- Smart contract risk

- Degree of decentralization

- Volatility

- Stability mechanisms

The higher the quality of stablecoin, the more likely the ShadeDAO will issue a bond to acquired said stablecoin. These stablecoins can be used to back Silk issuance, or to deepen liquidity on Shade Apps (such as ShadeSwap).

Scarce stores of value are non-yield bearing assets that are volatile, but with economic levers focused on value accrual due to a combination of long term scarcity and utility. Examples of this are Bitcoin, Ethereum, and Monero — all of which have deep liquidity, scarcity mechanisms (such as halvenings), and have historical relevance.

Liquidity tokens are service providing and yield-bearing assets that incur the risk of potential impermanence loss. Liquidity tokens are mathematical claims on a portion of tokens tied to liquidity pools on decentralized exchanges such as ShadeSwap. The more liquidity tokens owned by the ShadeDAO, the better the user experience and service provided by ShadeSwap.

Collateral List

The following is the initial list of prioritized assets targeted by bonds:

- stkd-SCRT

- stkd-SCRT / SHD LP

Initially, the ShadeDAO will be heavily focused on acquiring yield bearing assets and liquidity tokens during the beginning of the protocol’s lifecycle. Overtime, there should be a steady shift towards holding more and more stablecoins and scarce stores of value as adoption of Silk and Shade Protocol primitives solidifies.

Conclusion

Bonds are a powerful DeFi primitive that will help bootstrap, scale, and grow the ShadeDAO. Governance carefully manages the issuance of ShadeBonds so as to not introduce damaging liquidity shocks into the market. If balanced properly, bonds can be Shade Protocol’s primary tool for gathering protocol owned liquidity and yield.

With more key primitives being funded and built, more community members getting involved with Shade Protocol, and more supporters and partners than ever helping to ensure our global growth, the future has never been brighter for Shade Protocol and Silk.